Leadership:

Helping Others Increase their Financial Literacy

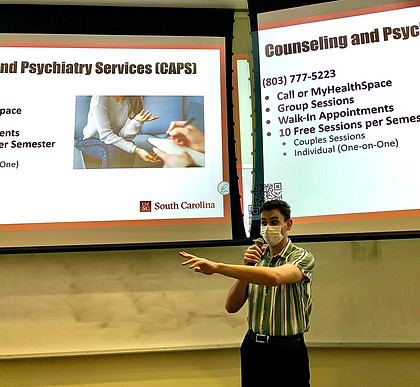

In Key Insight Three, I talk about how I fell in love with the idea of helping others manage financial risk. When I was younger, I experienced some financial difficulties when my father lost his job. When I became the chair of Mental Health Ambassadors, I realized that I was not the only kid that experienced financial insecurities as a child. I knew that I wanted to help people with these issues, since it is terrifying to me that finances have impacted so many people in a negative way. Studies show that it is not just a problem with students at the University of South Carolina. In the United States alone, approximately 53% of adults become anxious when they discuss their finances and that could easily be a result of the fact that 54% of millennials are anxious about their student loans, and 60% of adults accumulate large amounts of credit card debt each year. Fortunately, in Key Insight Two, I talk about how I found a job that will help me help others manage their financial risk. When helping my boss and one of his clients during a meeting, I realized how important it was for individuals to understand finances. In college, as elaborated in Key Insight Two as well, I have learned so many different financial models, theories, and formulas that have advanced my knowledge in finance and increased my financial literacy. As an intern, I understood more about this client's portfolio than he did, and he had been investing in it for decades. Though becoming an actuary will help me help others manage their financial risk, it is mainly indirect. If applied correctly, individuals will be able to use the information that I analyze to reduce the costs of insurances, and with some of their necessities costing less, their anxieties might lessen. Right? Well, in Key Insight Three, I talk about how important it is to talk about difficult topics, like finances and mental health, or more specifically, how finances can easily affect individuals mental health. As an actuary, which I am passionate about becoming, I won’t be directly communicating about these difficult topics. How can I write an entire portfolio without addressing the remaining discrepancy in my desire to help others manage their financial risk? Fortunately, there’s a simple answer. I won’t.

As a Mental Health Ambassador, I communicate the importance of prioritizing mental health. Now I need to begin communicating with those around me about finance. More specifically, I need to help those around me that did not have the same financial education that I did. Obviously, I’ll be able to talk about these things with those closest to me, like my partner, my friends, and my family, but I want to reach more than just them. Fortunately, like most Americans, those around me share an important commonality: social media. As of 2019, over 70% of Americans (not just adults) use some sort of social media. This makes my communication method easy: social media. Through social media, I can explain the importance of communicating about finances, the urgency of saving money sooner than later (I’m looking at you, compounding interest), and the value of budgeting. I believe, if everyone manages their money in these three ways to their personal preference, a large portion of financial anxieties would decrease significantly, and some might even disappear completely. For this to be effective, I will need an implementation plan.

To start, I would need to establish a brand. I would need consistency across my social media accounts, and a common brand would be the best way to do this. Once my brand is decided upon, I will need to begin enlisting help from my partner, a few of my friends, and my family. I would first talk with my partner, Emily, about her desire for involvement with this social media brand that I am developing. I would do the same with my parents, and a few of my friends. With their help, I would be held more accountable in posting and they would also help me develop a few series. First, with Emily, I could start a “Couples Series” where Emily and I talk about how we manage, invest, and spend our money together. This would be a great way for younger couples to see the value of communication, when discussing something serious like money. This is valuable, as nearly 25% of divorces are initiated because of financial stressors. I could do a similar series with my friends. For example I could talk about how important it is to set boundaries on prices, like how much you might be willing to spend at a restaurant when getting lunch with a friend, and if you’re wanting to split the check, pay separately, or treat them to lunch. Similar to marriages, finances can often tear apart friendships as well. Lastly, and most importantly, I could use my family’s experiences with financial hardships as a motivator to manage money correctly. Extensive research shows that real world experiences, examples, and storytelling are extremely effective in learning, and my family's experiences are just that. This would be a major framework of my social media brand. For reference, storytelling is the backbone of Mental Health Ambassadors, where we tell our stories to destigmatize mental health and promote mental wellness. I’ll do the same here and promote financial communication and promote financial wellness.

Sample Twitter Post

Sample Instagram Post

Through social media, I can share my experiences and the knowledge I have gained at the University of South Carolina. I will also be able to share the strategies I have been using that have helped my finances and consequently, my mental health. I can post graphics like the ones pictured above, that focus on investments, budgeting, and communication techniques. For the series, I can create Reels on Instagram or TikToks and post them simultaneously. I can judge how accounts are doing by their level of engagements, but I can also ask those that follow me how effective my suggestions are. Obviously, the more people that engage with the content, the better and more engaging my content is, but receiving a lot of engagement does not always mean my suggestions and recommendations are effective. Hopefully, at some point, I might receive some direct messages or comments from happy followers that appreciate the information that I am sharing with them. Lastly, I will split the types of information that I share among the social media accounts based on their average audiences. For example, I can post a lot of investment information on Twitter, where investing communities are common. I can post retirement information on Facebook, where a lot of users are older (not that you have to be old to invest in retirement funds). Finally, I can post general financial tips and nearly all other information to Instagram and TikTok, where people most like myself consume content. I also believe that Instagram is the best social media platform to focus on, since there is a large range of people among the users. In reaching out to those around me in a way that best suits them, I can directly improve their financial literacy, and as an actuary, I can indirectly affect their financial abilities. As a result of both, I can help everyone’s anxieties and mental health struggles in relation to their financial risk management.